Explained: What is growth capital and is it right for your business?

Ambitious business owners and entrepreneurs always have one eye on the future. But whether you want to strengthen your team, ramp up sales and marketing, build out your capabilities or expand your operations, securing the right capital is an important step in making your vision a reality.

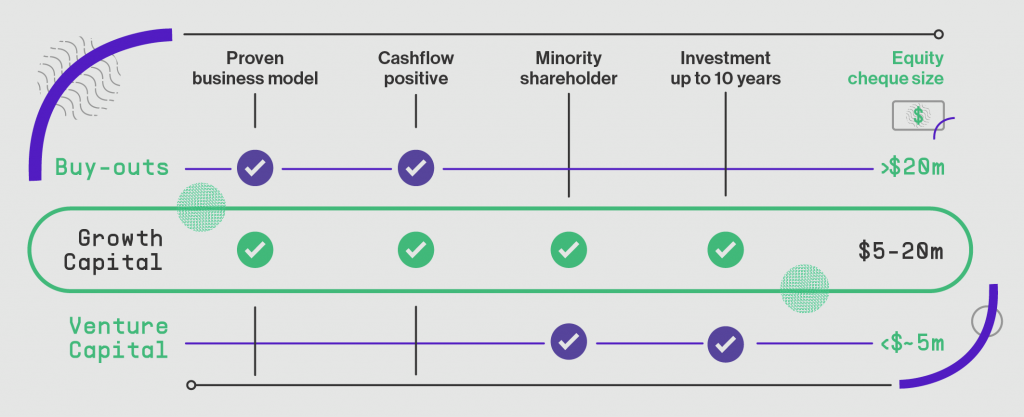

Growth funding is a type of equity funding designed to help businesses invest in growth opportunities that will enable them to scale. This guide provides an overview of growth capital, explains how it differs from other types of equity funding and details how to decide whether it is right for your business.