Three metrics to help you improve your cash flow management

For business owners looking to get a better grasp on the numbers and the financial health of their business, these three key metrics are a good place to start.

1. Working Capital Cycle

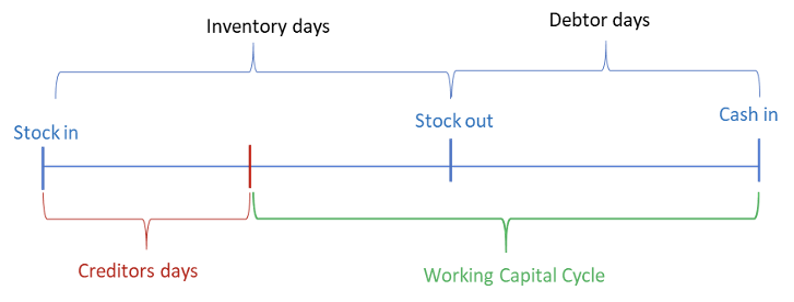

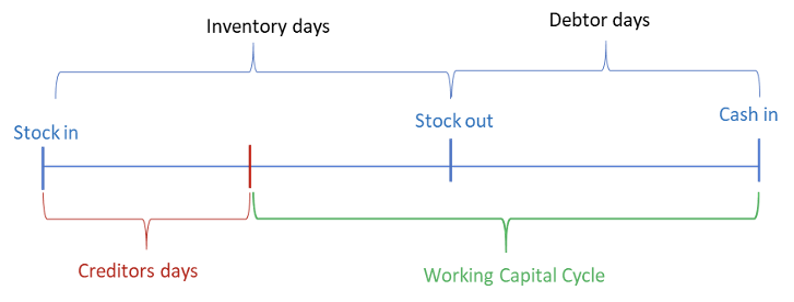

When evaluating the financial health of a business, investors seek to understand its ‘working capital cycle’. This cycle is made up of three parts:

Inventory days How long the company sits on its inventory

Debtors days How long it takes the company to collect cash from its customers

Creditors days How long the company takes to pay for goods and services it receives from suppliers

Once you know these answers, your working capital cycle is a simple equation: (Inventory days + debtors days) – (creditors days)

Working out the difference between the sum of your Inventory and Debtor days and your Creditor Days reveals the gap between cash leaving and coming in. A large gap, or a working capital cycle that is increasing over time, may indicate a cash flow crisis on the horizon.

2. Free Cash Flow (FCF)

A key metric in assessing your business’s financial performance is the business’s ability to generate Free Cash Flow (FCF). FCF is the cash that the business generates from its operating activities, after taking into account capital expenditures (CAPEX). This measure identifies your business’s ability to generate positive cash flow from its products and services and helps you understand its true profitability.

FCF is typically expressed as:

FCF = Operating Cash Flow – Capital Expenditures

If money is tied up in outstanding accounts receivable, overstocked inventory, or high CAPEX, you might run into liquidity issues, even if you’re generating large profits.

3. Debt Service Coverage Ratio (DSCR)

Another useful metric to consider is your business’s debt service coverage ratio (DSCR). DSCR is a measure of the business’s ability to meet its short-term debt obligations. The ratio shows the company’s earnings as a multiple of its debt obligations due within one year.

Debt Service Coverage Ratio = Net Operating Income / Short-Term Debt Obligations

(also referred to as “Debt Service”)

A DSCR of less than 1 means a business might not be able to cover its debt obligations without additional sources capital injection (equity/debt).

Cash flow issues can stop a profitable, growing business in its tracks and impact its future longevity and prosperity. But with accurate financial information, planning and support, the business owners can take control of the business’s financial future.