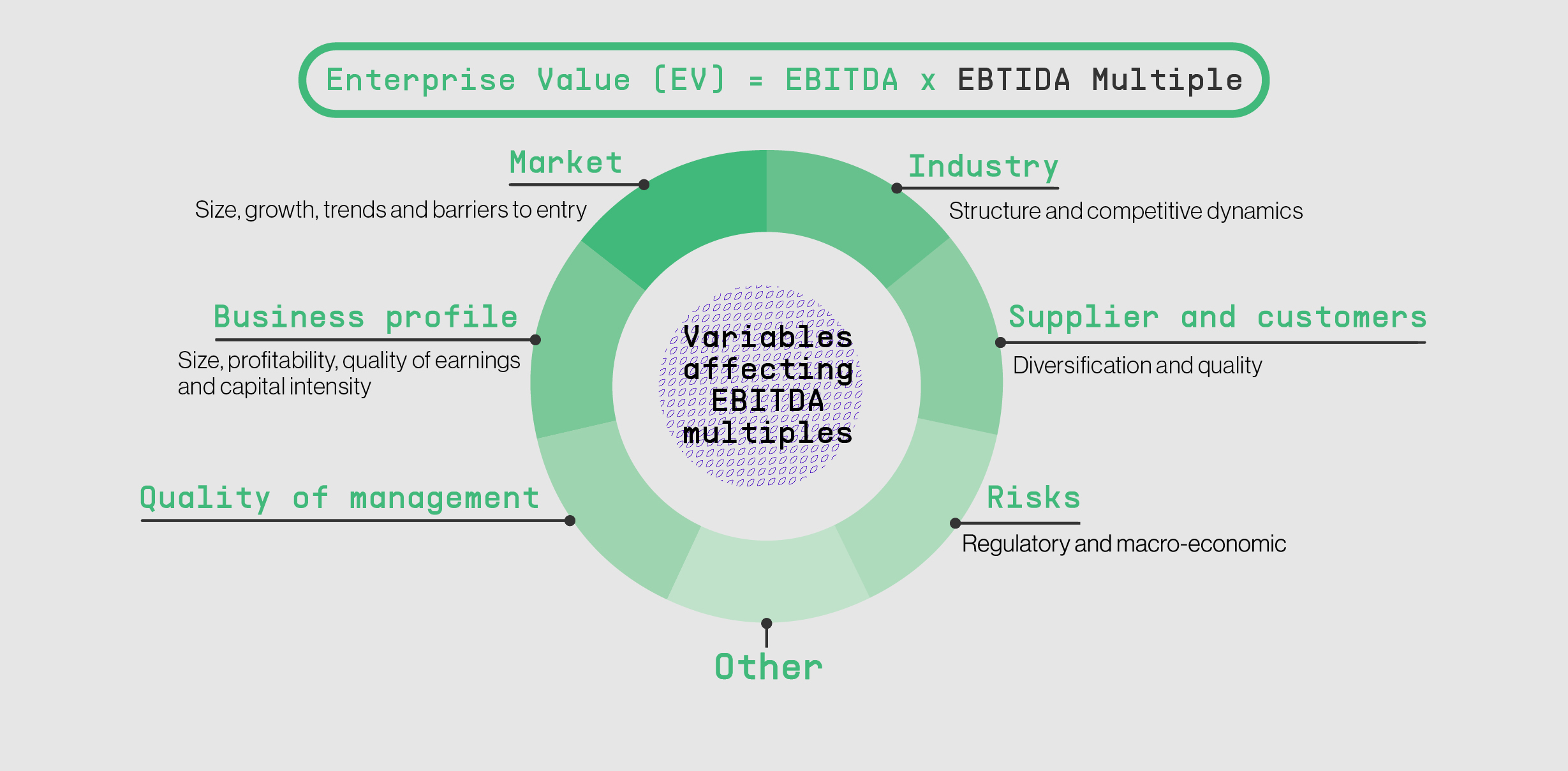

A business’s EBITDA multiple can be influenced by a wide variety of factors, depending on the investment opportunity. Here, it might be helpful to refer to our home-buying analogy (Figure 2).

First, just as property investors consider the city or neighbourhood likely to offer the best return on investment, so do growth investors when they consider the growth and risk potential of the industry in which the business operates. They’ll want to understand the industry’s growth rate and whether the sector is bursting with new innovations, or if it’s a sunset industry on the decline.

Investors will also seek to understand current or potential macro trends as well as legal and regulatory issues impacting the industry. Most important, however, is for investors to understand how your business is positioned to navigate these and other ‘big picture’ challenges. Great business owners typically know their industry inside and out and are prepared to pre-empt any concerns investors might raise.

Just as a homebuyer who’s picked out an ideal neighbourhood then begins comparing specific houses, so do investors as they evaluate a potential investment against other opportunities in the market. As Figure 2 shows, investors will assess factors such as your competitive position and the growth rates of similar businesses. Importantly, they will try to understand how much other businesses, similar to yours, have sold for recently. Think of this as preparing a real-estate classified, just for businesses.

Figure 2: Illustrative comparison between assessing a business and property value

Lastly, just like a home buyer does during a building inspection, investors will dig into the finer, internal details of how a business operates. This includes getting to know the strengths and weaknesses of the leadership team and understanding their plans to grow the business. Investors consider revenue projections and profit margins as well as the likelihood of those projections being realised. For instance, if a business has contracts in hand for a high portion of its projected revenue, this will give investors more confidence that the business can deliver as planned, compared to a business that is relying on estimates or new customers coming on board.

Another example of a risk factor investors will consider is your customer concentration – that is, the number of customers your business has, compared with the relative percentage of revenue they generate. This gives investors another opportunity to assess the risk associated with your projections. Businesses with few customers representing a large percentage of their revenue are generally inherently riskier than businesses with a highly fragmented customer base where the potential loss of a few customers is unlikely to result in a material decline in revenue.

Again, business owners can better educate investors of the potential upside of their business – or demonstrate how they can mitigate against the impact of potential risks – by putting their best foot forward. Being well prepared to answer tough questions about these and other critical business factors can make a big difference when it comes to pushing the valuation in the right direction.