2023: A year in review

Reflections from our CEO

As I look back on the calendar year 2023, it was a year of growth and opportunity for ABGF, against a background of challenging macroeconomic conditions, an evolving set of investment opportunities and ongoing work with our portfolio companies to help them realise their growth potential.

In 2023, “AI” became ingrained in our everyday vernacular; woman’s soccer took centre stage; the pandemic was officially declared over; global conflicts continued to capture our attention; India became the most populous country in the world; cost of living crisis, energy transition and the Voice referendum were focal points in politics; and financial markets were dominated by increasing interest rates as we hoped for a “soft landing”.

Against this backdrop, private equity markets slowed across the globe, with deal-flow the slowest in five years. Businesses prioritised bottom-line profit ahead of top-line growth, rebalancing their priorities and taking a more cautious outlook.

While investment activity slowed, we continued to see strong demand for growth capital in the SME market. During the year, we spoke with over 400 businesses, many with the same needs as previous years, but there have been some notable differences worth mentioning…

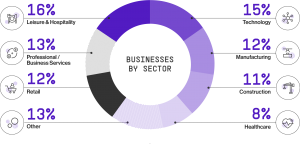

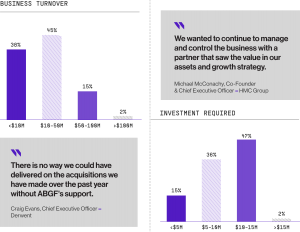

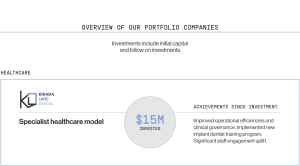

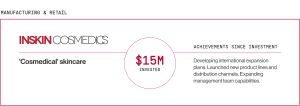

In 2023, we experienced a greater spread of demand across industries, with growing demand from professional/business services, manufacturing and retail, resulting in less dominance from technology and leisure/hospitality. The average size of businesses seeking growth capital increased and the vast majority of these businesses were seeking larger capital investments at the top range of our cheque size ($10-$15 million).

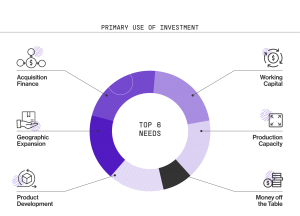

As businesses responded to the macro environment through the year, we experienced a shift in the purpose for which they were seeking investment. While acquisition finance took prime position, geographic expansion became the fastest growing reason for investment, and investment for product development decreased. This probably reflects more mature businesses with proven product/service offerings looking to expand their markets and diversify their customer bases, as opposed to smaller businesses bringing new products to market, which carries more risk in the current environment.

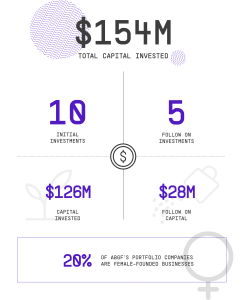

I recognise that there are things we can influence at ABGF, and there are things we can’t. If there’s anything I’ve learnt through the three decades of my career, it is to focus on the things we can control. That’s why I’m proud of the way the team has worked and supported our ten portfolio companies through the challenges of 2023.

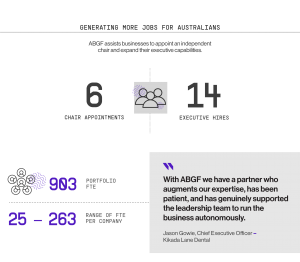

With our support, these companies have been able to make decisions and achieve things they couldn’t have done without our investment, our expertise and our connections – from attracting industry-leading board chairs and executives, to supporting acquisitions and post-merger integrations, enabling financial system upgrades, enhancing marketing and digital capabilities and establishing sound governance – highlighting our partnership approach and the team’s commitment and passion to ensuring the long-term success of our portfolio companies.

And so, we enter a new year – the Year of the Dragon – a year of endless energy and vitality. I think this sums up perfectly how I’m viewing the year ahead.

Anthony Healy

CEO and Managing Director