FY25: A year in review

Reflections from our CEO

The Australian economy is showing signs of gradual recovery amid persistent challenges. Corporate insolvencies have reached their highest level in 15 years, employment growth remains flat, yet consumer sentiment is improving in stronger state economies such as Queensland and Western Australia. Monetary policy has shifted toward easing, providing some business relief, while global trade settings have settled into a more predictable range.

Productivity has become a central domestic economic issue, with government priorities centred on workforce capability, technology adoption, and regulatory reform. These align closely with the themes we see across our portfolio and the broader growth economy.

Private capital markets are also seeing divergence, in this case between deal-flow for mid-market growth capital versus larger buyouts. While aggregate Australian M&A activity more than doubled in value during the year, mid‑market deals — our core focus — told a very different story, with values falling 22% and volumes down 14% (Pitcher Partners). The divergence highlights where real value creation is occurring. Structural headwinds (e.g. election cycle uncertainty and global trade frictions) are separating genuine business builders from short-term financial engineering plays. Inflation, market uncertainty and tighter governance standards have raised the bar for execution.

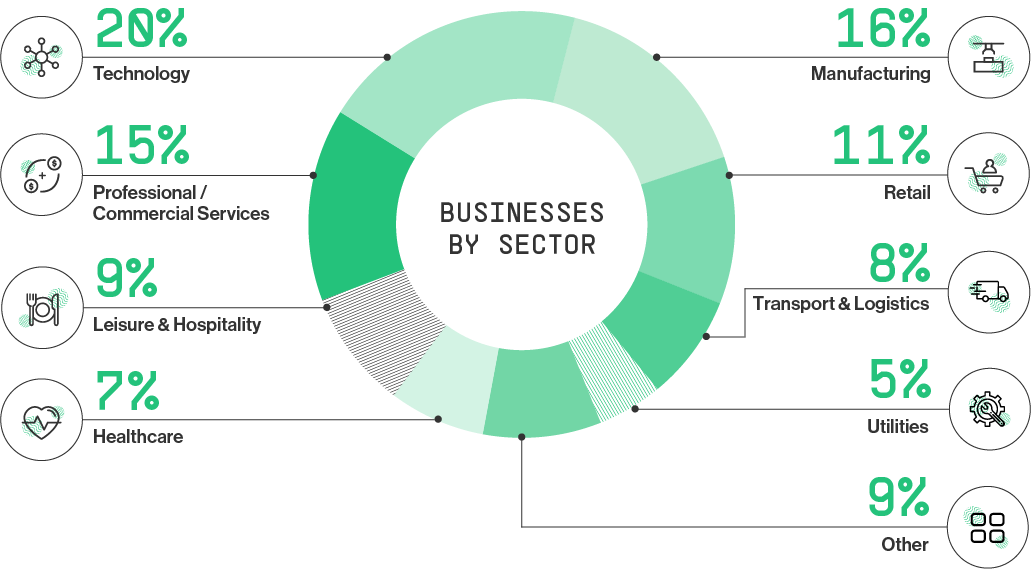

Our own pipeline illustrates these shifts. Technology has emerged as the leading sector at 20% of pipeline activity, driven by IT services, digital transformation, and cloud infrastructure. Manufacturing has strengthened to 16%, reflecting Australia’s ongoing reindustrialisation. By contrast, construction has fallen from 10% to just 6%, as investor appetite pivots away from property‑dependent businesses toward those with scalable advantages. Demographics are just as telling: 85% of dealmakers cite succession as a key driver of mid‑market M&A (Pitcher Partners), and we’re seeing more businesses with $10–100M turnover coming to market compared to last year – up to 57% of all businesses assessed by ABGF in the last financial year. Owners are increasingly recognising that the right capital partner can accelerate growth well before they reach traditional private equity scale. The challenge for deal-flow however remains founder uncertainty (as to whether to take on new capital with an uncertain economic outlook) and often, the gap in valuation expectations between owners and potential investors.

The scale of opportunity remains significant. Our Powering the Growth Economy report released last year, shows that 164,000 Australian SMEs with revenues between $2M and $100M account for only 6% of all businesses, yet deliver 42% of jobs, 47% of R&D, and 26% of GDP.

Despite this outsized contribution, a $38B equity shortfall continues to constrain the sector; 79% reporting access to funding as a growth barrier and 90% of funding that is accessed coming from friends and family rather than institutional investors, underscoring the critical role of professional growth capital in unlocking this opportunity. At an aggregate level, closing the gap would create significant uplift; potentially upwards of 24.5% revenue growth across Australia’s growth-oriented SMEs, the engine room of our economy.

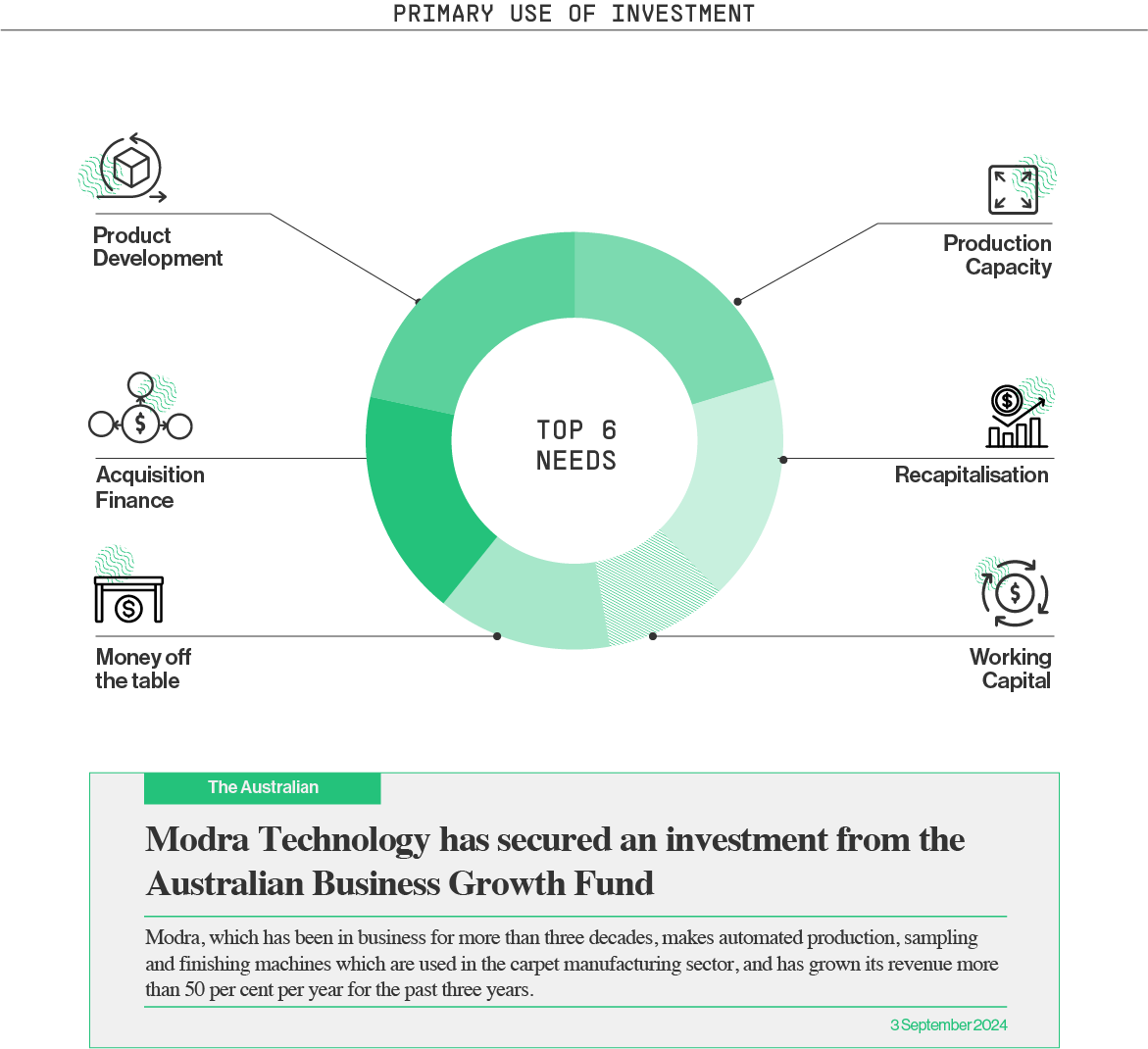

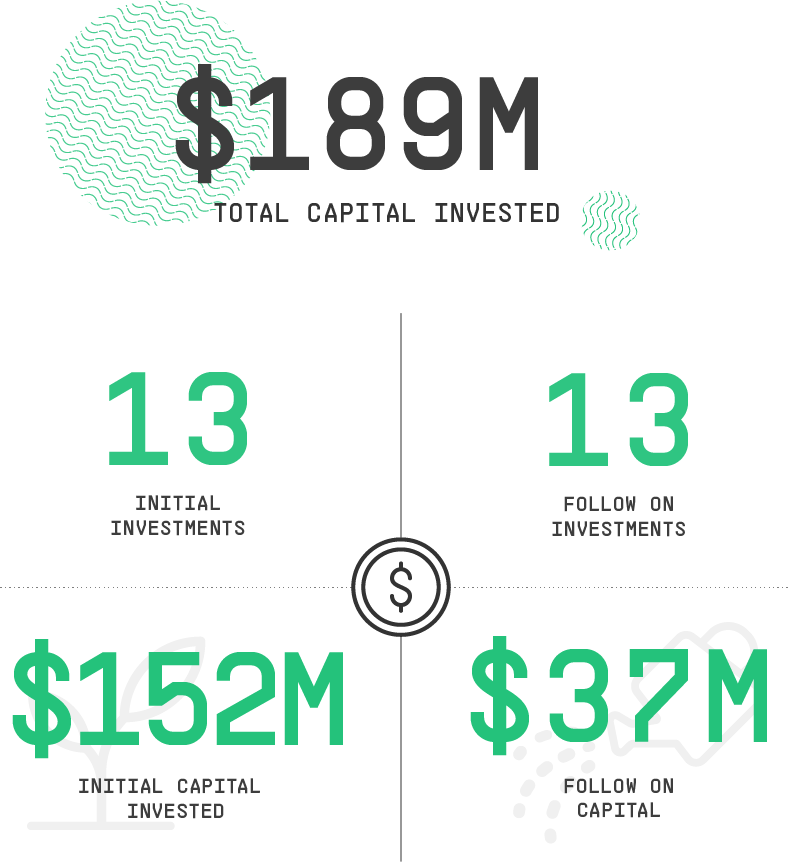

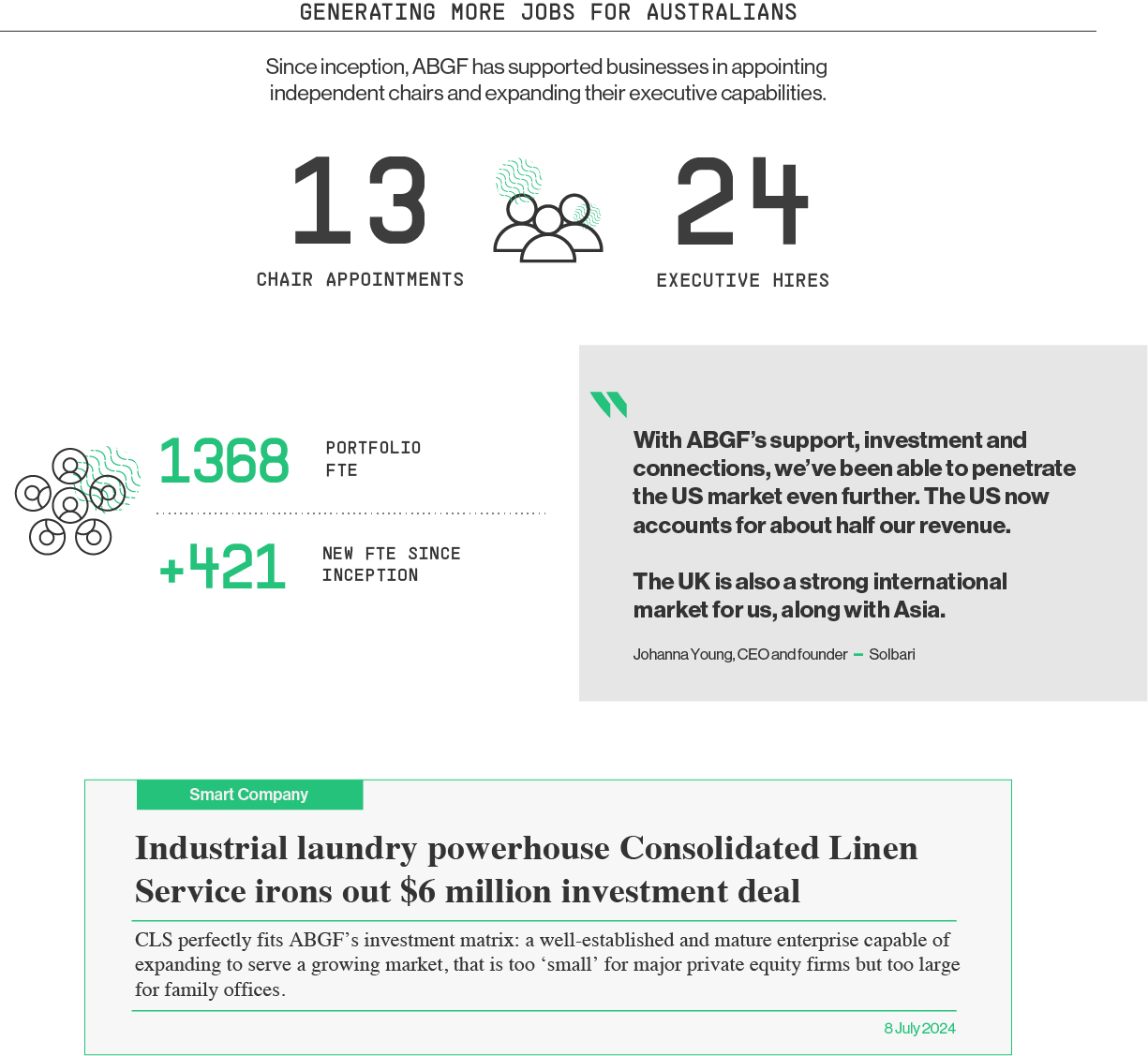

ABGF’s hands-on strategy is well suited to this environment. Over the past year, we committed capital across both new and follow-on investments, supporting companies with funding, governance, strategy, and leadership capacity. This approach has delivered new board and executive appointments, stronger portfolios, and meaningful workforce growth. Consolidated Linen Service (CLS) expanded its regional customer base while adopting automation to lift efficiency, and Modra Technology earned national recognition and secured major contracts after strengthening its leadership team, including new CEO and Chair appointments. These outcomes highlight the impact of patient capital paired with operational expertise.

Looking ahead, the economic outlook is slowly improving. Early recovery signals are evident across several sectors, even as uncertainty persists. Structural shifts — technology adoption, reindustrialisation, succession-driven ownership changes, and generational investment in energy transition, defence, and infrastructure — will define the coming period.

This is precisely where ABGF is uniquely positioned: the critical space between venture capital and large buy-out private equity where growth-oriented SMEs need both capital and strategic support. Those that thrive will be the ones balancing ambition with discipline, innovation with governance, and growth with responsibility, the profile of businesses we back.

As Voltaire reminded us, we must cultivate our own garden. For private markets, that means creating enduring value one portfolio company at a time, tuning out short-term noise and focusing on long-term value creation. Far from slowing, private markets are maturing, bringing the opportunity to build enterprises that perform across cycles while powering Australia’s growth economy.

Anthony Healy

CEO and Managing Director